It is important to create a checklist of expenses and allocate resources when planning to build a nonprofit organization. You can get funding fast, encourage more donors, and save enough money to sufficiently support the startup when you work on financial paperwork in advance.

While you may find initial fees and startup costs for your nonprofit manageable, they may still overwhelm you at some point. So, if you’re asking how much does it cost to start a nonprofit organization, you’ve come to the right place.

This article will guide you through this process and provide you with the most cost-efficient option whether you’re preparing for the legal or administrative cost for your nonprofit organization.

Quick Reads

Incorporation Cost

It is essential to know the incorporation fees before starting a nonprofit organization. Small and large organizations can significantly benefit from it but weighing the advantages and disadvantages is necessary.

If your group aims to start a nonprofit organization, you must visit your state to register as a corporation and get tax-exempt status. To become a corporation, talk to the Secretary of State and discuss filing articles of incorporation because the names of forms and filing fees vary.

An organization must file a legal document known as the articles of incorporation with the state government to incorporate a business legally.

It should contain organizational information that can serve as legal proof that it's established and eligible to operate in the state. If you are new to this, we suggest hiring a corporate lawyer to draft the articles of incorporation.

You may be required to pay between $50 and $200 in government filing fees to incorporate a nonprofit organization. This is separate from the filing fees you pay to the Secretary of State.

Government filings will depend on the type of business and the state where the organization is being incorporated. Most states require the following information in articles of incorporation:

- organization's name

- organization's principal business location

- the name and address of the organization's registered agent

- corporation's purpose in a statement

- duration of the organization

- the authorized number of shares and stocks in the corporation

- incorporators' names and addresses, or the names of directors and officers; and one or more incorporator signatures

Research about your state's nonprofit laws to learn how to start. Some states permit you to file online, while others can only provide templates for filing in person.

There are additional fees in every state other than incorporation that could add to the cost of starting a nonprofit. Business license and charitable solicitation fees may be part of it.

Filing for Tax-Exempt Status

Keep in mind that there are two separate processes when establishing an organization as a nonprofit and filing for tax-exempt status with the federal government. As a nonprofit organization, you have the option to seek tax-exempt status or not.

Nonprofits that perform research or provide an educational service typically apply for 501c3 status. However, there may be a different tax-exempt status for other associations and clubs other than 501(c)(3).

There are two forms to choose from when applying for 501c3 tax-exempt status:

- 1023-EZ form

- 1023 form

The 1023-EZ form is ideal for new or smaller nonprofits. If your organization has no more than $50,000 in gross receipts each year for the first three years, then you are eligible.

Furthermore, if you have no more than $200,000 in assets and are not established in a different country, along with other requirements, you can get the 1023-EZ form.

On the other hand, the 1023 form, which costs $600, requires you to declare the organization's mission, spending and projected budget, planned programs, board of directors, conflict of interest policy, and more. The form can be filled out here.

A lawyer or tax professional can also review the forms or file on your behalf other than paying the filing fees.

Charitable Solicitation Fees

The majority of the states require a charity to be registered first before performing fundraising activities. This is important because several states can protect residents from fraudulent fundraisers or scammers that steal money by posing as a genuine charity.

Therefore, you have to discuss the process with the state to report on your nonprofit organization’s fundraising activities, especially if it involves solicitation. We suggest that you check state solicitation laws first before deciding to fundraise.

Choose the state for registration where you have a physical presence and get new donors who can support the cause. You may also consider registering in other states after careful assessment. However, it may not be necessary to register if a large amount won’t be raised.

Administrative Cost

Knowing about the administrative cost is important because it will assist the operations and make it more efficient. It can show you how much money you need to shell out on production and promotion. In return, you can monitor expenses and adjust spending you deem fit.

Legal Fees

Hiring a lawyer can assist you in your nonprofit organization when preparing the following:

- Articles of incorporation

- IRS application

- other required legal documents

According to Nolo, the lawyer's fee structure and the services you will avail can affect the total cost of starting a nonprofit. Some lawyers may have an hourly fee that starts at $150 but this can go higher depending on years of experience.

A flat fee may also be proposed, especially if they need to set clear expectations with a client up front. While it may not be appropriate for every type of service, a flat fee for 501(c)(3) exemption paperwork, contracts, business formation, intellectual property, and real estate transactions can still be charged.

A combination of hourly and flat fees, or hybrid fees, is another option, especially in litigation. For example, a lawyer can charge a flat fee for preparing and filing a complaint and then hourly fees for trial work.

Whether you need to form a nonprofit organization, apply for charitable fundraising licenses and permits, or get a tax ID, feel free to check out LegalZoom–an online technology company for hiring lawyers.

Non-Profit Insurance

As a nonprofit organization that often works with the public, you may be exposed to many risks. General liability insurance can protect an organization against lawsuits that arise from accidents involving clients, participants, etc.

A liability policy covers the following:

- Customer injury

- Damage to customer property

- Other injuries connected to advertising

If an organization hosts a fundraising event, this coverage is recommended before booking an event venue or finalizing a contract with a client.

You need to consider several factors like organization size and coverage needs to determine the cost of nonprofit insurance.

Office Space

The office environment plays a crucial role in the staff’s productivity, engagement, and satisfaction. Moreover, it reflects the nonprofit organization and contributes to its growth and success.

Some things to take into consideration:

- Is the location accessible?

- Does the rental price suit the budget?

- How secure is the rental rate?

- How much space is needed?

- Do you need parking for the staff?

- Is a meeting room essential?

- Is the building law compliant?

Evaluating the requirements can allow you to better understand potential costs.

Hiring Recruitment Cost

At the end of each year, the budget planning process for nonprofits should indicate recruitment costs. Some of the challenges you may face may be the following:

- Hiring staff on a limited budget

- Finding qualified staff who will be long-term assets

- Effective scheduling for interview and recruitment

A qualified search firm for nonprofits like Averill is composed of fundraising consultants who offer the suitable model for executive search. This ensures that your nonprofit can access the database of candidate profiles interested in being part of the organization.

increase engagement to thrive continuously. Therefore, it is crucial to connect your nonprofit organization with the right audience and stay relevant.

Marketing and Communications

Before you plan how to market a nonprofit organization, make sure to define the target audience first or who you want to reach. After this, set measurable goals to evaluate the performance and determine what needs improvement quickly.

Social media enables you to build a dynamic online presence for an organization if used effectively. With over 233 million active users in the United States in 2021, it can be a huge opportunity to reach and engage with a broader audience.

An organization can build a marketing communications strategy to reach its target market through different ways of communication. It includes the message, the medium, and the target audience. It should have three guiding principles: brand, customer, and budget.

You may opt to hire a digital marketing agency to help expand your business online, which may typically range between $5,000 to $20,000 in the United States.

On the other hand, you also have to decide on how much of your budget for print marketing materials like brochures, shirts, tumblers, or pens should be.

Organization Website

A website for an organization can help increase its credibility. It enables partners and donors to confirm the legitimacy of the organization.

Moreover, having an own domain makes it more professional when applying for grants or asking for donations. People can easily access it to get more information about your organization.

The first step is to purchase a domain for your organization’s website. It will serve as the address people enter into a web browser when they visit the website. The domain name is unique, and no other organization can use it.

Bluehost offers unique domain options like .com, .net, .org, and more for only $12.99 per year.

After getting a domain, you can now build a website, which may cost as low as $20 per month if you prefer using website builders like Squarespace or Wix than hiring a website designer.

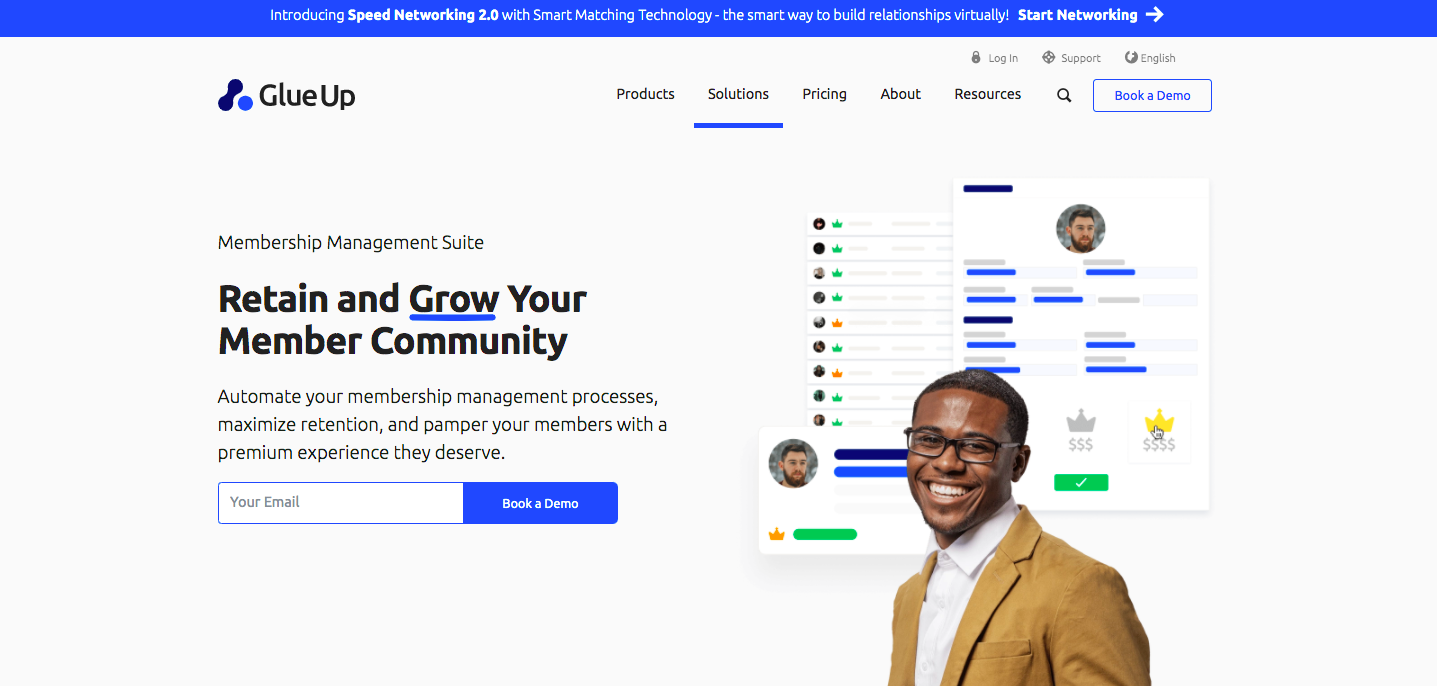

If you are looking to enhance your online presence with a professional, mobile-responsive website that seamlessly integrates with a membership management platform, be sure to check out Glue Up’s website solution.

With its drag-and-drop builder, you can choose from different website template designs, add new pages, post ads, and many more with ease.

Graphic Designer

Hiring a graphic designer is essential in creating visual concepts to communicate the organization’s message. Their tasks are to create logos and other marketing materials.

Hiring a graphic designer is essential in creating visual concepts to communicate the organization’s message. Their tasks are to create logos and other marketing materials.

You can have them work in-house to develop designs specifically for your organization. Another option is to hire a freelancer who works with various clients.

If you have limited graphic design knowledge but would want to build and design business cards, logos, and other presentations on your own, Canva has a drag-and-drop tool you can use for free.

It is important to have an email account for your domain name to appear more professional whether you’re handling a team or managing a nonprofit organization. It’s the web address that comes after the “@” symbol in an email address.

For example, in an email like me@nonprofitname.com, “nonprofitname.com” is the email domain.

A custom domain name typically costs $14.99 per year. In line with this, email hosting services start from $9.88 per month, which you can pay annually.

Bluehost gives you a free email domain with a shared hosting plan and a free SSL certificate for $2.75 per month.

Security

Keep in mind that a URL with https indicates the site is secured by an SSL certificate, which will help to keep you protected when visiting various websites.

For better site security, SSL cert is essential and you need to assess the site's requirements. It can be either a single domain, wildcard SSL brand like Comodo PositiveSSL Wildcard or any multi domain product from popular brands.

All these SSL types offer the same level of encryption with covering different domain requirements.

Nonprofit Software

If you want to centralize all your nonprofit organization's membership data in one place, easily manage membership renewals, and automate processes, be sure to book a demo of Glue Up's Membership Management software.

As you gain deeper insights into memberships, it helps you improve member engagement and streamline marketing campaigns as well.

Technology Grants to Bring Your Cost Down

Google Ad Grants

Are you looking to raise awareness, attract donors, and recruit new volunteers? Using Google search ads can be your best bet.

People searching for nonprofits can engage with your message through Google Ad Grants. A qualified nonprofit can access up to $10,000 per month in search ads shown on Google.com. With a separate account, you can easily purchase additional Google Ads.

![How to Write Compelling Emails for Fundraising That Get High Response Rates [With Tips, Best Practices, and Templates] How to Write Compelling Emails for Fundraising That Get High Response Rates [With Tips, Best Practices, and Templates]](/sites/default/files/styles/all_blogs_block_img_384x192/public/2024-01/header-1536x768%20%281%29emails.png?itok=hC4nhg1w)

![Creating Nonprofit Affiliate Structures - A 5-Step Guide [With Common Issues and Best Practices] Creating Nonprofit Affiliate Structures - A 5-Step Guide [With Common Issues and Best Practices]](/sites/default/files/styles/all_blogs_block_img_384x192/public/2023-03/nonprofit%20affiliate%20structure.webp?itok=sQKoOcln)