![A Guide To Membership Revenue Forecasting for 2024 [with Tips, Models, and Examples] A Guide To Membership Revenue Forecasting for 2024 [with Tips, Models, and Examples]](/sites/default/files/2023-11/forecasting%20membership%20revenue.webp)

Forecasting revenue is a critical yet challenging task for membership-based organizations.

With unpredictable economic conditions and evolving member needs, relying on simple projections based on past performance is no longer enough. You need reliable forecasts to drive budgeting, manage cash flow, and make strategic decisions.

Read on to understand how you can forecast revenues accurately by leveraging the latest models, tools, and best practices. You'll also learn techniques for analyzing historical data, projecting future trends, dealing with uncertainty, and using forecasting software to improve planning.

Key Takeaways

- Membership revenue forecasting involves predicting future revenue for member-based organizations using historical data and trends.

- It differs from projection in that it accounts for potential risks and uncertainties.

- Accurate forecasting is critical for budgeting, cash flow management, and informed decision-making.

- Top models include backlog, bottom-up, top-down, pipeline, moving average, linear regression, and straight-line.

- Tips for improving accuracy include analyzing historical data, accounting for seasonality, and regularly reviewing projections.

What is Membership Revenue Forecasting?

Membership revenue forecasting is the process of estimating the amount of revenue your organization can expect to generate over a future period. It involves analyzing historical revenue data, membership trends, and other metrics to predict incomes and cash flows.

Forecasting provides organizations with visibility into potential financial outcomes based on different scenarios and assumptions. This allows for more informed budgeting, resource allocation, and strategic planning.

Read more: 2024 Guide to Planning, Budgeting, and Forecasting for Member-based Organizations: Key Differences and How to Execute Them

Membership Revenue Projection vs. Forecast - What’s the Difference?

A membership revenue projection is a basic estimate of future revenue based solely on historical data. It doesn't account for potential risks, uncertainties, or changes in the business environment.

A forecast goes a step further by incorporating assumptions about factors that could impact revenue, such as economic conditions, market trends, and competitive forces.

Forecasting models use advanced statistical techniques to provide revenue ranges or confidence intervals. This allows organizations to plan for upside and downside risks.

While a projection shows the most likely result, a forecast gives a more realistic picture of potential revenues, allowing for better contingency planning.

Why Is Revenue Forecasting Important for Membership Organizations?

Revenue forecasting holds significant importance for membership organizations.

Organizations with accurate revenue forecasts are 10% more likely to achieve their financial targets and 15% more likely to hit their growth goals.

This accuracy in forecasting allows organizations to craft realistic budgets, manage cash flow more efficiently, and allocate resources effectively.

Below are key reasons why membership-based organizations require accurate revenue forecasting:

1. Budgeting

Revenue forecasts allow membership organizations to develop practical budgets that align with projected income and expenses.

Rather than guessing income and costs for the upcoming fiscal year, forecasts provide finance teams with data-driven estimates. This prevents organizations from over or under-budgeting.

2. Cash Flow Management

Along with budgeting, forecasts empower organizations to optimize cash flow.

By anticipating peaks and valleys in revenue, membership groups can ensure adequate liquidity to cover near-term costs. It protects cash flow from potential problems.

With expected cash inflows and outflows mapped out, you gain the flexibility to adjust investments as needed. Proactive cash flow management provides financial stability.

3. Informed Decision Making

Reliable revenue forecasts enable membership organizations to make better decisions around pricing, recruitment, programs, staffing, and more.

Management can use projections to determine appropriate membership fee structures, identify the need for membership drives, evaluate new services, and right-size staff. This data-driven approach maximizes the impact of investments.

Top 7 Revenue Forecasting Models for Member-based Organizations

1. Backlog Revenue Forecasting Model

The backlog model leverages revenue from existing committed business that has not yet been formally recognized. For membership organizations, this includes membership fees from current members based on historical renewal rates.

By analyzing renewal patterns, the backlog model can estimate the portion of existing members expected to renew and generate future revenue. This provides a baseline of revenue based on the existing member roster.

2. Bottom-Up Forecasting

With bottom-up forecasting, organizations build up an overall revenue forecast starting at the granular level. For example, membership organizations can forecast new members versus renewing members separately based on historical trends and growth rates.

These detailed forecasts are then aggregated to come up with a total revenue projection. The bottom-up approach provides transparency into the assumptions and drivers behind the forecast.

3. Top-Down Forecasting

The top-down forecasting method takes the opposite approach of the bottom-up method. High-level, organization-wide projections are made first using past revenue, growth rates, and economic indicators.

The overall forecast is then broken down into specific revenue streams or business units. This approach is quicker and provides a big-picture view, but lacks granular details.

4. Pipeline Revenue Forecasting Model

Pipeline models allow organizations to directly incorporate sales activities into the revenue forecast. By tracking leads and opportunities at different stages of the membership funnel, conversion rates can be applied to estimate how many will close as new members.

Pipeline reporting reflects the momentum underway in sales and marketing. It accounts for investments in member acquisition.

Moving Average

With the moving average technique, past revenue over set periods is analyzed to identify trends, cycles, and seasonal fluctuations in the data. The average change in revenue over time can then be used to forecast expected future revenue.

A key benefit of the moving average is smoothing out unusual spikes or dips to reveal the underlying pattern.

Linear Regression

Linear regression modeling identifies the mathematical relationship between input drivers and revenue through statistical techniques. Key revenue drivers are tested to derive the equation that most closely aligns with historical revenue.

This relationship is then used to estimate future revenue based on the expected values of the input variables.

Straight-Line

The straight-line methodology is the simplest approach. It assumes revenue will continue increasing or decreasing at the same constant rate as it has done historically. While easy to calculate, it risks missing changes in the underlying business conditions.

Combining multiple models provides a robust forecast by leveraging their respective strengths while minimizing the weaknesses of any individual approach. This diversity of techniques improves accuracy.

Tips for Improving The Accuracy and Speed of Membership Revenue Forecasting

Improved forecasting accuracy can result in substantial financial benefits.

For instance, a 15% increase in forecast accuracy can result in a 3% or higher pre-tax profitability improvement. Additionally, a 1% reduction in forecast error can lead to a 0.4% reduction in inventory or a 0.6% reduction in shortages.

This underscores the importance of accurate forecasting as it not only leads to better business decisions but also directly enhances profitability.

Here are some tips for generating more accurate forecasts efficiently:

- Analyze at least 3-5 years of historical revenue data to identify trends and seasonality. More data leads to more reliable forecasts.

- Account for one-time anomalies or outliers that could skew the numbers. Focus on long-term trends.

- Factor in changes to membership dues, benefits, recruitment incentives, and other variables that impact revenue.

- Consider economic factors, market forces, and competitive landscape that could affect future revenue.

- Break down revenue by member cohort, location, demographics, and other segments to improve granularity.

- Review forecasts monthly and forecast quarterly to account for new data and changing assumptions.

- Leverage forecasting software tools that quickly crunch numbers and provide customizable analytics.

- Use rolling forecasts that add a new period as time passes rather than static annual forecasts.

- Combine predictive analytics with the experience and intuition of finance leaders.

Learn How to Forecast Membership Revenue: A Practical Example

Let's look at an example of how a professional membership organization can forecast revenue for the upcoming year:

- Current Revenue: The organization has 10,000 members who each pay $100 in annual dues, so the current run-rate revenue is $1,000,000.

- Historical Growth Rate: Historical data shows membership has grown 5% annually over the past 3 years.

- Renewal Rate: The renewal rate has averaged 80% over the past few years.

- New Member Target: The sales team aims to add 2,000 new members next year.

- Conversion Rate: The average conversion rate for new members is 10%.

- Forecasted economic conditions: strong for the industry next year.

Using this data, the organization can forecast:

- Existing member revenue: 10,000 x 80% renewal x $100 = $800,000

- New member revenue: 2,000 x 10% conversion x $100 = $200,000

- Total forecasted revenue = $800,000 + $200,000 = $1,000,000

This $1,000,000 forecast represents a 5% increase over the current $1,000,000 run rate, aligning with historical membership growth trends.

Top 4 Software for Membership Revenue Forecasting

With tons of data to process at hand, make sure to leverage professional software to streamline and automate your revenue forecasting.

Here are 4 top options you should consider:

1. Glue Up

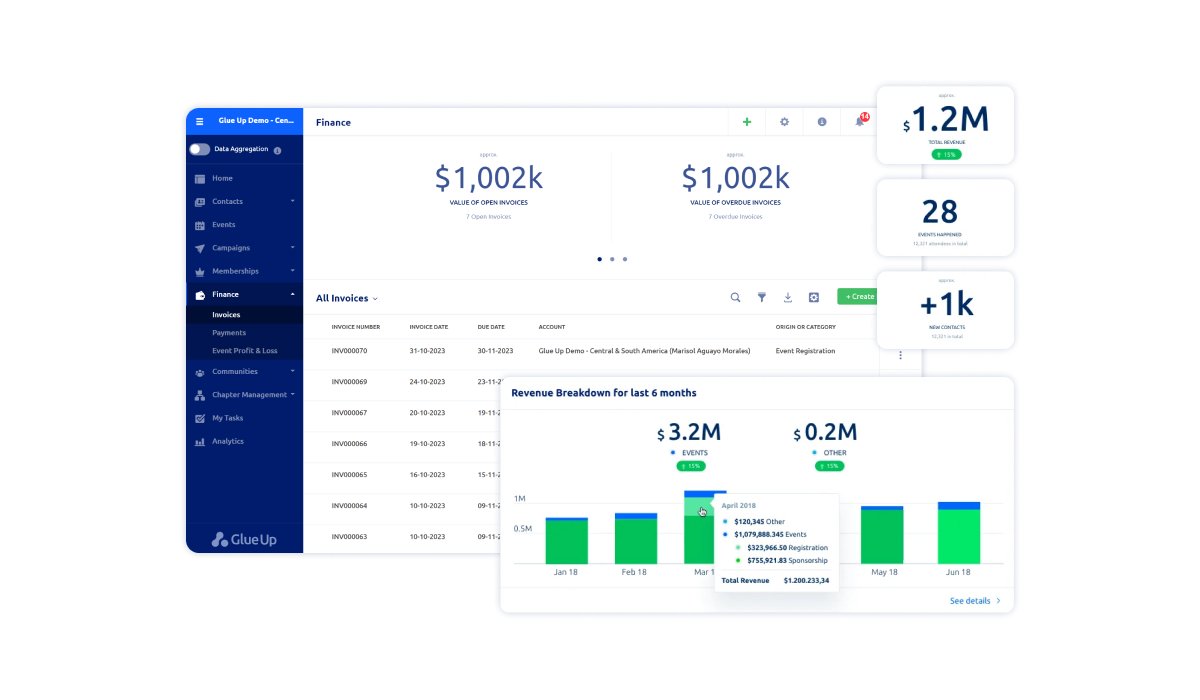

Glue Up is a versatile membership management platform designed to offer real-time insights into revenue data, which is crucial for organizations that rely heavily on membership fees.

Although it's not forecasting software in the traditional sense, you can integrate it with robust accounting software like Xero to streamline your forecasting process.

This results in:

- A real-time view of your organization's financial health, allows you to stay on top of everything that's happening.

- Ensures that all financial data is accurate and comprehensive, facilitating detailed revenue analysis.

- ensure that all member-related data is integrated into the revenue forecasting process, offering a more holistic view of the organization's financial status.

- ensures that all financial data is up to date across various platforms, reducing the risk of errors and providing a reliable basis for forecasting.

Overall, Glue Up is an excellent choice if you’re looking to enhance your membership revenue forecasting capabilities. Its combination of real-time data, integration with accounting software, and robust forecasting tools make it a valuable asset for effective financial management.

2. ProfitWell

Tailored for organizations with subscription-based and recurring revenues, ProfitWell utilizes sophisticated statistical models for accurate forecasting. Its features include predictive modeling, scenario planning, and detailed revenue analytics.

The system integrates with billing systems to spot trends, optimize pricing strategies, and reduce customer churn. It also offers customizable APIs and professional forecasting services.

4. Zuora

Providing a complete solution for subscription management and recurring revenue, Zuora comes with built-in forecasting abilities. It offers highly customizable forecast models, including rolling forecasts, territory planning, quota management, and commission calculations.

Enhanced with machine learning and analytics, Zuora continually improves forecasting accuracy and integrates with CRM, ERP, and financial systems, besides offering specialized services to refine subscription forecasting.

4. PlanGuru

This adaptable software specializes in budgeting, forecasting, and financial modeling, offering custom templates for various organizations and industries. PlanGuru supports driver-based revenue forecasting models, collaborative planning, and scenario analysis.

Integrated with Excel for effortless reporting, it also boasts features like variance analysis, allocation modeling, and automatic data imports.

When evaluating forecasting software, consider factors such as:

- Modeling capabilities

- Customization

- Data integration

- Collaboration tools

- Reporting functionality

- Support levels

Look for systems that provide accurate forecasts tailored to your revenue models while being user-friendly for your staff. Additionally, automation and advanced analytics can streamline the forecasting process for your organization.

Get Ahead for Next Year: Start Forecasting Today

By starting forecasting early, you can ensure your organization is well-prepared for the future, allowing you to focus on delivering value to your members and achieving your mission.

Additionally, leveraging software solutions like Glue Up can streamline the process and provide valuable insights into your membership revenue. Get a demo to learn more about Glue Up’s financial integration capabilities and how they can contribute to your organization's success.