You may be familiar with the terms ‘questionnaire’ and ‘survey’ already and may think they are the same. However, the only similarity between the two is that they ask a series of questions, but it all ends there.

Now that you know that they may differ in many ways, this article survey vs questionnaire will give you a deeper understanding of both and offer some valuable tips for designing them.

By the end of this, you will also learn their differences and when to use them. Also, we will show the common mistakes to avoid for you to gather the right information, calculate results, and analyze data more effectively.

Quick Reads

- What Is a Questionnaire?

- What Is a Survey?

- What’s the Difference? Are Surveys and Questionnaires the Same Thing?

- Why Do People Mix Up the Two?

- Survey vs Questionnaire: When to Use?

- Survey vs Questionnaire: Common Mistakes

- 3 Tips For Creating Your Own Surveys and Questionnaires

What Is a Questionnaire?

A questionnaire contains questions that aim to gather specific information from respondents. It is designed to learn about a particular group’s attitudes, preferences, and other information.

In line with this, it focuses on the smaller group that represents the wider population. Since the sample is small, it’s easy to study and reduces the surveyor’s work while ensuring statistical data quality.

Using a questionnaire is one of the most affordable ways to gather quantitative data.

It lets you collect the information in a relatively short amount of time. This is evident when you opt to prepare a self-administered one, wherein participants answer a written set of questions without an interviewer.

Apart from being cost-efficient, it’s a practical way to gather information as it’s focused on a target group that lets you manage data in different ways.

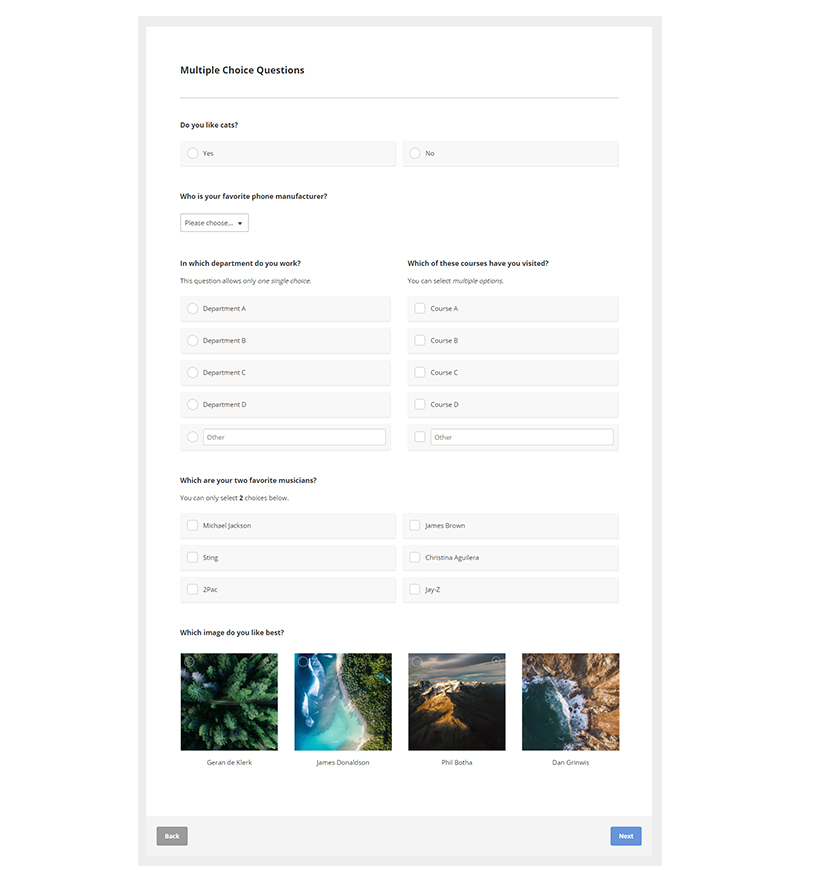

There’s an opportunity also for you to choose the survey questions and the format, which is either multiple choice or open-ended.

You can create a questionnaire using online and mobile tools. They optimize surveys for mobile, and you can quickly gain insights within 24 hours or less.

A questionnaire can appear on a company website or be sent to customers via email. While this may not cost a lot, strong targeting is necessary to gain a high response rate that generates accurate results.

For example, launching a 2-day event can allow you to hold quizzes, create polls, and distribute questionnaires. This allows you to obtain real-time feedback with ease.

An online questionnaire is a great option if you need fast but quality feedback. It allows you to make informed decisions in the shortest time possible.

What Is a Survey?

A survey can take multiple forms, but the most common is a questionnaire, that is either online or on paper. It contains a list of questions needed to obtain information from a sample of people, which is essential in generalizing the results to a larger population.

It is a useful tool when obtaining extensive data to describe the characteristics of a large population. It covers a sample that generates targeted results to arrive at conclusions before making decisions.

What’s more, it is an inexpensive common source of data and insights from industries like telecommunication, construction, education, transport, and media, among others.

There is no need to spend a lot on executing online surveys and mobile surveys per respondent, compared to when conducted via phone or on paper.

An online survey is the most common of the two examples above. To capture thoughts, expectations, and even frustrations, respondents have to complete a set of structured questions by filling out a form.

It is less time-consuming and natural to reach out to target respondents since it’s structured and answered online. A database stores all data for further evaluation by a field expert.

Offering incentives to get people to take online surveys can increase response rates. Rewards can be VIP access, social media shoutout, gift cards, or accumulated points that they can redeem for unique items. Doing this can benefit both an organization and respondents, as you get to obtain valuable data from a clearly defined environment essential for market research methods.

Surveys are flexible and can be administered in other ways like email, social media, paper telephone surveys, or face-to-face. Suppose most respondents are remote or hard to reach. In that case, we advise you to perform a mixed-methods approach, wherein online surveys and paper surveys are combined for easy data gathering and analysis.

What’s the Difference? Are Surveys and Questionnaires the Same Thing?

Surveys contain questionnaires that have a mixture of open-ended and closed-ended questions ideal for different types of data collection within a particular group. One thing to note here is that a survey cannot exist without the questionnaire.

A survey deals with the way questions are delivered to the audience, the process of data collection, how to determine the right audience, and other questions related to the methods of collecting information. On the other hand, when we talk about a questionnaire, this includes questions and potential answers in a survey.

If you are designing a survey strategy, other factors like cost, willingness to participate, coverage, and data collection should be part of it. However, these have no effect on the questionnaire that remains the same.

For instance, you want to get feedback from the audience about the best event management software. Asking for information or reactions about a product can be obtained via email, phone, online form, or face-to-face. So, questionnaire vs survey—are they really different from each other? Questions and answers remain the same, but the various ways to get the questions to the respondents can change.

Why Do People Mix Up the Two?

Data gathering using questionnaires and surveys before the Internet was totally different from today. They used to be completed on paper and manually counted after to be summarized and analyzed separately.

At the present time, there are survey tools that have combined the process of data collection and interpretation. With a single tool, you can do both quickly, which makes the process easier and more affordable.

Survey vs Questionnaire: When to Use?

A survey helps collect audience feedback proactively. With it, you can gain a deeper understanding of their needs and experiences. Moreover, it allows you to determine if others find your products and solutions valuable.

Conducting a survey is a great way to engage the audience if the primary purpose is to get feedback right after an experience. For instance, sending one to a customer after using your products or solution can help you gain insightful data to address specific concerns or issues.

Lastly, if customers have just discontinued their subscriptions with an organization, a survey works best for discovering why they chose to leave.

It would be better to use a questionnaire if you have a large audience for evaluation with essential answers for various purposes.

In addition, questionnaires are an effective tool for gathering information when creating an email list, job interviews, or obtaining data for order processing.

If you want detailed data on a particular topic, they should contain a set of different forms of questions. Some of these can be open-ended, yes or no, multiple-choice, and many more.

When you summarize all the answers gathered in a questionnaire, they can be considered a part of a survey. On the contrary, keep in mind that survey questions are broader and cannot become a part of a questionnaire.

Survey vs Questionnaire: Common Mistakes

When customers see that their opinion matters through a survey or a questionnaire, they feel appreciated, and customer loyalty will be strengthened.

To help you craft the best survey questions, here are the most common survey and questionnaire mistakes you need to avoid.

Mistake #1: Asking Open-Ended Questions

Open-ended questions cannot be answered with a simple ‘yes’ or ‘no’. But instead, respondents have to explain their answers further.

When writing a survey, asking open-ended questions can help you understand customers or better investigate the reasons behind their satisfaction or dissatisfaction with what you offer.

For this reason, including ‘please explain’ or ‘explain how’ after every question is acceptable but mention it only twice so as not to overdo it.

Survey participants experience fatigue when there are too many open-ended questions. In return, this can increase drop-out rates, which can stop you from achieving the right data.

Mistake #2: Constructing Confusing or Complicated Questions

Loaded questions in a survey or a questionnaire is another common mistake that leads to respondents abandoning the set of questions.

There’s often confusion in the set of questions provided, which pushes the audience into answering a question in a way that doesn’t reveal true thoughts or emotions.

For example, “Where do you shop during weekends?” is a loaded question. It’s considered as such as it assumes that people shop every weekend even though some don’t.

While there are those who can find the question valid, some may choose to abandon the survey or others may answer but will not tell the truth.

To make it more effective, you need to reconstruct the question and split it into two sentences:

- Do you visit the mall during weekends?

- If you enjoy shopping, which mall do you prefer?

Mistake #3: Asking Too Many Questions

Another reason for increased drop-off rates is asking too many survey questions. The data quality may also suffer as respondents often fail to provide well-thought answers when faced with this type of approach.

Also, survey length is directly linked to response rates. If it takes more than 15 minutes to answer a set of questions, you can expect response and completion rates to drop as well.

Mistake #4: Designing Questions That Are Not Mobile-Friendly

Respondents use different types of devices to take a survey. For this reason, it’s advisable to choose an app that’s responsive for both desktop and mobile.

Most survey apps today work well on mobile. But still, make sure to preview a survey on the mobile device first to check if it will look good for all users.

Mistake #5: Asking Leading Questions

Leading questions direct respondents to answer in a specific manner, based on how each question is formulated.

Often these questions already contain information that the surveyor intends to confirm rather than try to obtain in an unbiased manner.

A survey fails to serve its purpose if biases are present in these leading questions. Therefore, you cannot attain insightful reports using the collected data and responses.

Mistake #6: Writing Unclear Jargon or Acronyms

Aim to write in a clear and concise language for the audience to comprehend the survey’s intent or message. Refrain from using acronyms or writing technical terms and jargon that may only confuse others.

For instance, if respondents are people in the same field of study or occupation, you can use jargon and still be understood. On the contrary, if you’re speaking to a larger audience outside the defined group, refrain from using it at all costs.

Mistake #7: Making Surveys That Are Too Long

Reading hundreds of questions spread out over plenty of pages can cause respondents to disengage and reduce their attention span.

This means readers will lose interest, so they’ll either stop filling out the survey and quickly provide random answers to get it done. When this happens, they become less attentive, which negatively affects the accuracy of data.

Research says a good rule of thumb is to aim for a survey that takes no more than 15 or 20 minutes to complete. You can keep it short and precise by limiting it to 10-15 survey questions.

Mistake #8: Ambiguous Questions or Unclear Response Options

An ambiguous question has no specific query. It could have more than one meaning that requires several responses, without a clearly defined subject.

Using ambiguous questions in a survey, respondents could have different interpretations of the meaning of words or phrases that aren't clear. In return, you can get a wide range of responses that can pose more risks than benefits to the data that you need.

An example of a generalized or a vague question is: “Did you enjoy it?” This isn’t a good question to ask as it doesn't specify what the audience was supposed to enjoy. Also, survey participants may like only a part of the activity but not the entire experience.

Example of an NPS Survey

Credits: MailChimp

Example of a Questionnaire

3 Tips For Creating Your Own Surveys and Questionnaires

Surveys are distributed to assess the thoughts and experiences of a target audience. When done right, the obtained data is essential in making important decisions. Here are some tips to creating effective surveys and questionnaires:

1. Keep It Simple to Be Understood

Have an audience in mind and know their characteristics as well. When you’ve determined this, you can easily relay ideas using the language and tone they are familiar with and will understand. If there are concepts or terms that respondents need to comprehend before they can give answers, provide the definition first.

2. Mention the Survey Duration

It can be helpful to communicate how long a survey will take to the audience. This is for them to set aside enough time to complete it. You can either mention the survey length in the introduction or show a progress bar as they move toward the end.

3. Choose the Best Survey Software to Collect Feedback

Survey software is an application that helps organizations extract data from a target group. It’s easier to accomplish, speeds up data collection, and is more accurate than manual surveys.

Online surveys that are tied to survey software are currently experiencing rapid growth. According to Technavio, survey software market size will increase at a compound annual growth rate (CAGR) of 9.05% from 2020-2024.

If you're looking for survey software to design, send, and analyze data, book a demo of Glue Up’s Surveys Solution. With ready-made templates, you can create surveys for your audience with ease. All you have to do is choose a preference among different design options, add some questions, and generate data automatically for better decisions.

Do you want to measure ROI, improve customer loyalty and retention, new member acquisition, and boost revenue targets? We have just launched the Membership Engagement Scorecards (MES), which is part of the analytics platform that consists of tools to measure member engagement. What’s more, it automatically gives a score to members based on a set of quantitative criteria. Be sure to check it out!