You’re on your second cup of coffee, staring at a spreadsheet that’s begging you to reconcile last month’s payments. Half the entries look like hieroglyphics, and you’re trying to figure out which vendor didn’t get paid. It’s a headache, one that many organizations deal with every single day. But what if you didn’t have to? What if payments could just...work?

That’s the promise of payment automation. It’s a practical solution to a very real problem. And if you’ve ever dealt with late fees, irate vendors, or the stress of balancing the books manually, this guide is for you.

The real problem with manual payments

Manual payment processing is like trying to cook a five-course meal in a tiny kitchen with no recipes. You might pull it off, but the process will be chaotic, and the chances of burning something or everything are pretty high.

Here’s what happens when you rely on manual systems:

One misplaced decimal or incorrect account number can throw your whole budget out of whack.

Late payments damage relationships with vendors and members alike.

Instead of working on big-picture strategies, they’re stuck chasing invoices or tracking down missing payments.

You’re always playing catch-up, never fully sure where your finances stand.

What exactly is payment automation?

Payment automation replaces those messy, manual processes with software that does the heavy lifting for you. Think of it as a financial autopilot; it handles everything from generating invoices to reconciling accounts, so your team can focus on things that actually matter.

Here’s a quick breakdown:

Automatically processes incoming invoices, assigns codes, and routes them for approval.

Handles repeat transactions, like memberships or vendor bills, without you lifting a finger.

Automates the entire vendor payment process, from invoice receipt to payment execution.

Tracks overdue payments and sends reminders automatically to get your money faster.

Why your organization can’t afford to ignore automation

The stakes are too high to stick with outdated systems. Automating your payments doesn’t just make things easier; it fundamentally changes how your organization operates.

1. Fewer errors mean fewer headaches

Manual financial processes can be messy. Typos, misplaced decimals, or missed invoices are frustrating and costly. Automation reduces these errors by up to 37%, according to the Institute of Finance & Management (IOFM), and can cut processing costs by 80%.

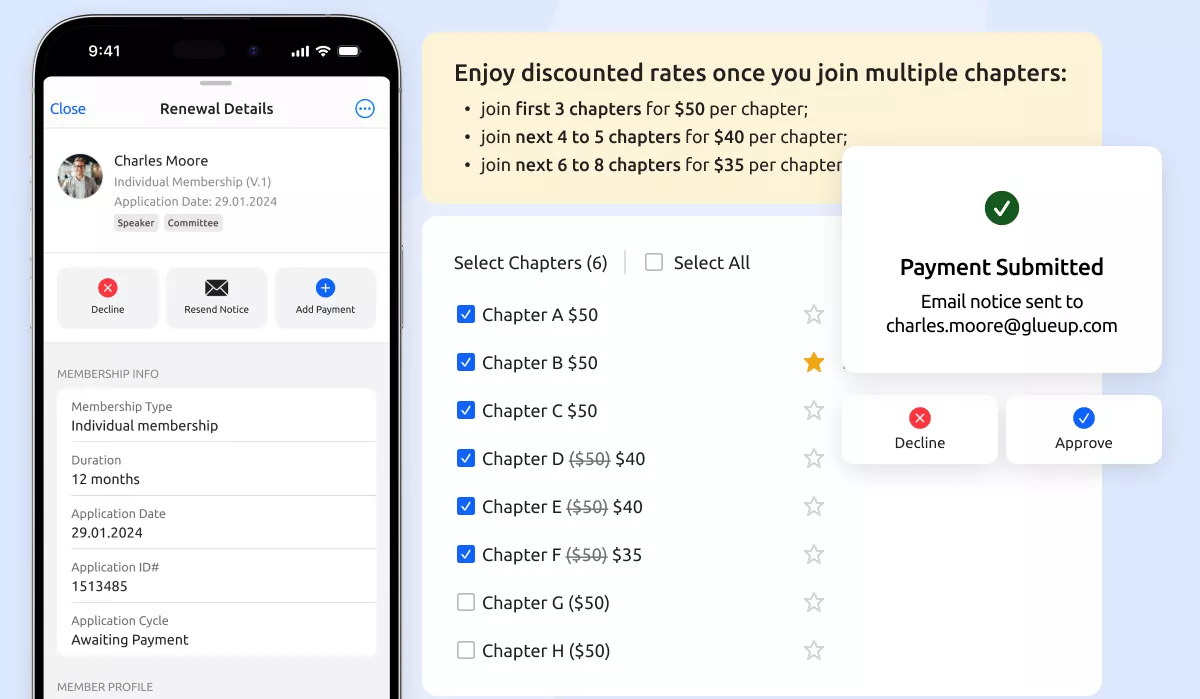

Tools help ensure payments are accurate and compliant with policies that saves you from duplicate payments or incorrect data entries. For organizations like associations and chambers, automating dues collection and payments with tools like Glue Up brings similar accuracy, while streamlining member management.

2. Real-time cash flow visibility

Trying to keep track of your cash flow manually is like driving without a dashboard, you’re guessing the whole way. Automation gives you real-time updates on incoming and outgoing payments.

Deloitte found that organizations using financial automation software see a 25% improvement in cash flow forecasting. Tools like QuickBooks Online, NetSuite ERP, or Glue Up’s finance features offer dashboards that show your balances, invoices, and payment schedules instantly.

Knowing exactly where you stand means smarter decisions for spending, saving, or investing.

3. Time saved = more strategy

How much time does your team spend processing payments or chasing down invoices? McKinsey reports that automating repetitive tasks saves 30-40% of a finance team’s time. Imagine redirecting that energy toward strategic projects like budgeting, forecasting, or planning growth initiatives.

Glue Up enables associations to streamline dues collection and membership renewals in minutes. Less time on admin means more time on high-impact work.

4. Better relationships with members and vendors

Late payments are inconvenient, and they hurt relationships. Automation ensures your payments are always on time, which strengthens trust with vendors and members alike. PYMNTS.com reports that businesses using automated payment systems reduce late payments by 67%.

Tools send reminders and process payments as soon as they’re approved. For member organizations, Glue Up helps manage dues and payments reliably that builds goodwill and ensures long-term loyalty.

Glue Up: The solution your team needs

Glue Up’s finance management tools are specifically designed for member-based organizations makes it easier to handle payments while managing memberships seamlessly.

Here’s what sets Glue Up apart:

Say goodbye to manual invoice generation. Glue Up creates, sends, and even tracks invoices for you.

Members and vendors can pay how they want; whether it’s credit card, bank transfer, or online payment.

Get a 360-degree view of your finances, from overdue invoices to real-time cash flow.

Glue Up keeps your transactions safe, meeting global security standards.

How to get started with payment automation

Switching to payment automation isn’t as intimidating as it sounds. Here’s a step-by-step plan to make it happen:

Audit your current system: Identify bottlenecks in your payment workflows. Are you spending too much time on invoicing? Struggling with overdue payments?

Set your goals: What do you want automation to achieve? Whether it’s reducing errors or improving cash flow visibility, be clear about your objectives.

Choose the right tool: Look for a platform (like Glue Up!) that aligns with your needs and integrates seamlessly with your current systems.

Train your team: Make sure everyone knows how to use the new system and understands its benefits.

Monitor and optimize: Track your results and tweak processes as needed to maximize efficiency.

Common concerns about automation (and why they’re myths)

“Won’t automation be expensive?”

Think of it this way: What’s the cost of manual errors, late fees, and wasted time? Automation might have upfront costs, but the ROI is undeniable.

“Is it hard to implement?”

Not with Glue Up. Our platform is user-friendly and comes with dedicated support to help you get up and running quickly.

“Will it replace my team?”

Automation doesn’t eliminate jobs; it makes them more meaningful. Your team will spend less time on tedious tasks and more time on strategic projects.

Stop letting manual payments hold you back

If you’re tired of dealing with errors, wasting time, and playing catch-up with your finances, it’s time to make a change. Glue Up makes it easy to automate your payments, giving you the tools you need to focus on what really matters: growing your organization.

Ready to take the leap? Book a demo today and see how Glue Up can transform your financial workflows.