Running an association or chamber of commerce often means juggling multiple priorities at once—managing events, coordinating memberships, supporting community initiatives, and keeping finances in check. But behind the scenes, the financial aspect can quickly become a challenge, especially when your processes are spread out across various systems. Without centralized finance management, organizations can face delayed decision-making, poor cash flow visibility, and, ultimately, missed opportunities.

The solution to these issues lies in adopting a centralized approach to finance management. In this post, we’ll break down how this strategy can level up your organization and why it’s crucial for building strong financial health over time.

Improved Cash Flow Management

One of the most critical aspects of financial health for any organization is maintaining positive cash flow. Without a clear understanding of where money is coming in and going out, it’s easy to find yourself scrambling to meet financial obligations. Centralized finance management solves this issue by offering visibility into cash positions.

By consolidating financial operations into one system, organizations can monitor both cash inflows and outflows seamlessly. For associations and chambers, this means no more scrambling to check multiple accounts or spreadsheets for updates. With a unified system like Glue Up, you gain real-time insights into your available liquidity and can make proactive decisions to avoid cash flow bottlenecks.

For instance, automated invoicing and payment tracking ensure that dues, event payments, and other transactions are promptly processed. Instead of waiting for monthly reports to get a snapshot of your cash position, you can view up-to-the-minute data from anywhere.

This continuous flow of information helps associations make informed decisions on budget allocations, event planning, and membership management. The result is usually less financial stress and more financial freedom to focus on growth.

Data-Driven Choices for a Better Future

For associations and chambers, having quick and easy access to accurate financial data can be the difference between seizing a timely opportunity or missing out. With a centralized finance management system, the days of relying on outdated reports and guesswork are over.

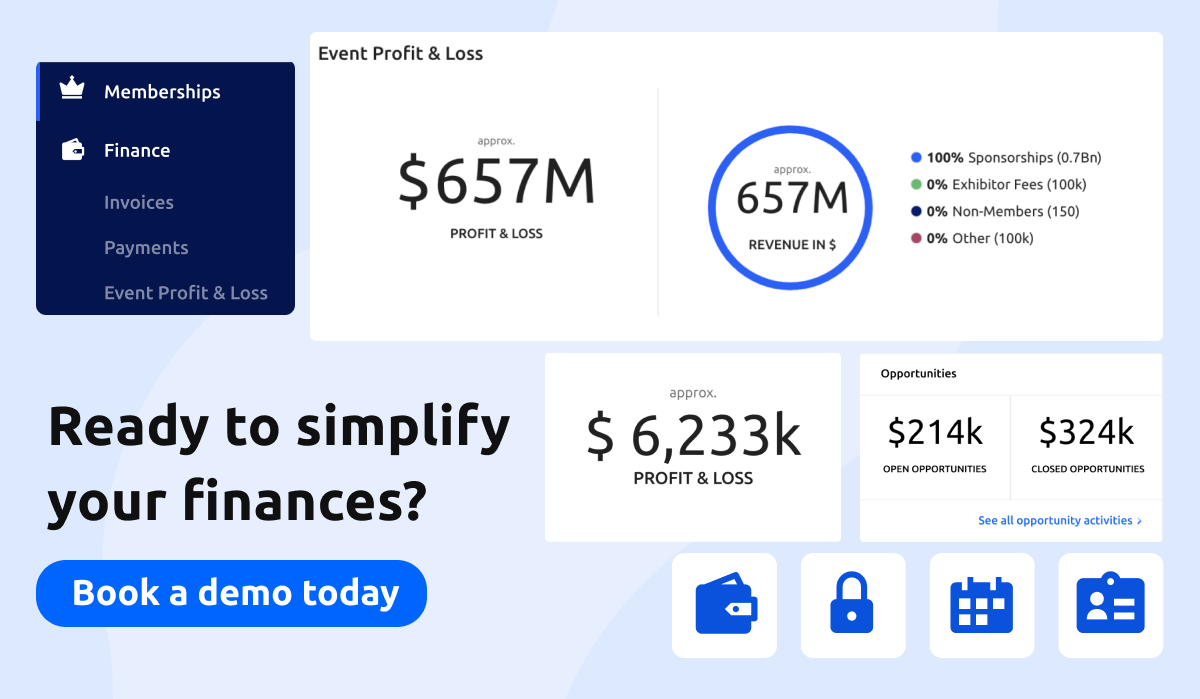

Glue Up’s platform consolidates your financial data and presents it in a user-friendly dashboard that’s accessible in real-time. This means finance teams and organizational leaders can make critical decisions on investments, cost-cutting strategies, and resource allocation, quickly and with confidence.

Let’s say your chamber is considering investing in a new initiative or planning a large-scale event. Instead of second-guessing your financial ability, you can check your current cash position and projected revenue in real-time.

This transparency allows for better strategic decisions on how funds should be allocated—whether that’s securing venues, negotiating with vendors, or launching new programs. Informed decision-making becomes a goal and a built-in advantage when your data is centralized and at your fingertips.

Streamlined Processes and Increased Efficiency

Centralizing finance management helps eliminate redundant tasks across departments, streamlining processes, and reducing manual effort. Think about how much time your team spends manually entering financial data into multiple systems. With a centralized system like Glue Up, that redundancy is eliminated and that frees up your team to focus on more strategic initiatives.

By automating payment processing, invoicing, and even tax calculations, you free your team from the burden of administrative tasks. No more chasing after missing receipts or double-checking spreadsheets. Everything is processed, tracked, and recorded in one place and nothing slips through the cracks.

Furthermore, this increased efficiency means reduced operational costs. Whether its fewer administrative hours spent on manual data entry or the reduction of banking fees through consolidated transactions, centralizing finance management allows associations to allocate resources more effectively. You get more done, faster, with fewer mistakes, ultimately increasing the organization’s overall productivity.

Enhanced Risk Management

When financial operations are decentralized, risk management becomes an uphill battle. With multiple systems in place, there's a higher risk of errors, fraud, and even compliance issues. Centralized finance management helps mitigate these risks by providing better oversight and control.

With Glue Up, every financial transaction is logged, tracked, and easily accessible. By implementing standardized financial policies across the organization, you ensure that compliance is consistent and that your organization adheres to all necessary regulations. Additionally, centralized systems make it easier to spot discrepancies or signs of fraudulent activity early, providing greater transparency and accountability.

This added level of oversight reduces the likelihood of financial missteps and fosters trust within your organization. Members, stakeholders, and even your finance team will have confidence in the financial operations of the association or chamber, knowing that they are transparent, secure, and compliant with industry standards.

Cost Reduction

One often-overlooked benefit of centralized finance management is its ability to drive cost reduction. For associations and chambers, the financial savings can be significant. By consolidating accounts and streamlining payment processes, organizations can often negotiate better rates with financial institutions due to the increased volume of transactions.

By automating financial processes, organizations can reduce administrative expenses, freeing up funds for more strategic activities. Whether it’s launching new membership programs or expanding event offerings, you can invest your saved resources back into the growth of the organization.

Better Collaboration and Communication

A successful finance team relies on seamless collaboration and clear communication. When financial data is spread across different systems or departments, it can lead to confusion, inefficiency, and even errors. Centralized finance management solves this issue by creating a single source of truth for all financial data.

Glue Up’s platform provides real-time access to financial reports and dashboards for all relevant stakeholders, ensuring that everyone is on the same page. Whether you’re coordinating with the accounting team, event organizers, or department heads, you’ll all be working from the same data. This level of collaboration fosters better communication and more efficient project management.

Transform Your Financial Strategy Today

Centralized finance management is an essential tool for associations and chambers aiming for long-term success. By improving cash flow visibility, enhancing decision-making, streamlining operations, and reducing costs, this approach can transform how your organization manages its finances.

If you're ready to streamline your financial operations and make smarter, data-driven decisions, it’s time to explore how Glue Up can help. Our platform’s centralized finance tools provide real-time insights, increase efficiency, and reduce risks—empowering you to focus on what truly matters: growth and success.

Ready to take control of your finances?