Managing your association’s finances can feel like walking a tightrope, where one misstep, i.e., declining renewals, rising costs, or a cybersecurity threat, could disrupt everything. But financial risk management can transform that tightrope into a steady path.

If your association is still unsure about effectively managing financial risks in 2025, it could face significant challenges anytime. Financial risk management balances books and protects your organization’s future.

This blog will guide you through the essentials of financial risk management, and you’ll gain access to a free cheat sheet packed with practical steps to address risks. Stick with us to the end for a comprehensive understanding and tools to secure your association’s success.

Association Financial Risks Explained

Financial risk refers to the possibility of losing money or experiencing financial instability due to various factors.

Financial risks can arise for associations from unstable revenue streams, rising operational costs, compliance issues, or unforeseen events that disrupt budgets and cash flow. If unmanaged, these risks can threaten an organization's sustainability and effectiveness.

Types of Financial Risks

To effectively manage financial risks, you must first understand the different types your association might face. Only 38 percent of organizations have a dedicated function actively assessing risk and reporting it regularly.

Each type presents unique challenges, and if you know about them, you will be able to take the right steps to protect your organization. Here are the notable financial risks you should be aware of:

- Revenue Instability: Your association may rely heavily on membership dues, event fees, or sponsorships. Any fluctuation in these revenue streams, such as lower renewals or reduced attendance, can disrupt your cash flow and financial planning.

- Rising Operational Costs: Increases in expenses for staffing, technology, events, or facilities can quickly strain your budget. If these costs grow faster than your revenue, you could experience financial stress.

- Regulatory and Compliance Risks: Failing to comply with tax laws, labor regulations, or nonprofit standards can result in fines, penalties, or legal complications. These impact your finances and also harm your association’s reputation.

- Investment or Reserve Fund Risks: Poorly managed investments or insufficient reserve funds can leave you unprepared for emergencies or economic downturns. Without a strong financial safety net, unexpected costs could put your association at risk.

- Fraud or Cyber Threats: Cybersecurity breaches, phishing scams, or internal fraud can result in financial losses, legal liabilities, and loss of member trust. Over half (53 percent) of treasury professionals report that cybersecurity risk is currently the most challenging risk to manage. Protecting financial data and maintaining oversight are crucial for avoiding these risks.

Proven Strategies for Financial Risk Management

The main strategies you can adopt to effectively avoid and manage financial risks in your association are as follows. Acting on these will strengthen your organization’s financial stability and resilience.

Diversify Income Streams

Relying solely on membership dues is risky and can leave your association vulnerable to revenue fluctuations.

Diversify your income by hosting events and offering sponsorship opportunities. For example, an industry association held an annual trade show that generated $50K from ticket sales and an additional $30K from sponsors, doubling their event revenue from the previous year.

Another association introduced a tiered membership system. Twenty percent of members upgraded to premium tiers, resulting in an extra $25K annually. These strategies boost income and create more financial stability for associations.

Establish Financial Reserves

Building an emergency fund guarantees your association can handle unexpected shortfalls, such as a drop in renewals or unplanned expenses. Allocating a portion of your revenue each year helps build a safety net to handle unexpected challenges.

For instance, your association can set aside 15% of annual income to create a reserve fund. This fund ensures you can cover budget shortfalls, such as a $20K deficit from lower event attendance, without affecting core operations.

A strong reserve provides the flexibility to address financial uncertainties confidently and securely.

Automate Financial Tracking

Automating financial tracking gives your association greater control and visibility over its finances. Real-time tools monitor expenses as they occur, certifying that nothing slips through the cracks.

Suppose an organization implemented an automated system to track monthly expenditures. Within the first quarter, they identified a 10% rise in utility costs and adjusted their budget to avoid overspending.

Automation prevents potential budget shortfalls, reduces manual errors, and allows organizations to focus on strategic planning instead of repetitive tasks.

Regular Financial Audits

When you conduct regular financial audits, your association improves financial management and accountability. Audits confirm compliance with regulations and help you avoid penalties or legal issues.

An audit can reveal duplicate payments in vendor invoices, potentially saving your association up to $10K annually or more. Regular audits provide transparency to stakeholders, build trust, and reinforce your association’s commitment to responsible financial practices.

Insurance Coverage

When you secure appropriate insurance coverage, your association safeguards its assets, staff, and operations against unforeseen risks. Insurance policies help mitigate potential losses from incidents like property damage, liability claims, or event cancellations.

For example, an organization insured its facilities and equipment, which allowed it to recover $50K in damages after a storm severely damaged its office space. Having the right insurance in place protected its financial stability and minimized disruption to its operations.

Benefits of Proactive Risk Management

Managing financial risks offers several advantages for your association. Taking early action to identify, assess, and mitigate risks safeguards your organization’s financial health and enhances long-term success. Here’s how:

Financial Stability and Resilience

Proactive risk management helps your association build a strong financial foundation. Identifying and addressing risks early helps your association handle unexpected challenges, reduce the likelihood of budget shortfalls, and maintain smooth operations.

For example, if your association experiences a sudden drop in membership renewals, a reserve fund can help cover any financial gaps that will allow you to continue operations without interruption.

Increased Member Trust Through Transparent Financial Practices

Regularly assessing and managing risks shows your association’s commitment to financial transparency. Members feel more confident knowing their dues and contributions are managed responsibly, which leads to increased trust and long-term loyalty.

If you share regular financial reports and updates, members are more likely to view your organization as reliable. This leads to a higher rate of membership renewals and a stronger sense of security.

Improved Decision-Making for Long-Term Success

Proactive risk management provides clear financial insights, which leads to better decision-making. A solid understanding of your association’s financial health enables informed decisions that support sustainable growth, secure future funding, and enhance overall member value.

By tracking key financial metrics, your association can identify which programs yield the highest ROI. This allows you to prioritize successful initiatives and reduce those that aren't generating value, which leads to better resource allocation and higher growth potential.

Using the Financial Risk Management Cheat Sheet

The Financial Risk Management Cheat Sheet is structured to provide you with practical tools and templates that will guide you through managing financial risks for your association.

Here’s a quick breakdown of each section:

Risk Identification Checklist

This section helps you identify and categorize potential financial risks your association may face. It includes a simple list of common risks, such as revenue instability and operational cost increases, to help you assess which apply to your organization.

Budgeting and Forecasting Templates

These templates allow you to plan your association’s finances, track income, and estimate future costs. Using these templates, you can better forecast cash flow and identify potential financial gaps before they become critical issues.

Financial Health Indicators Tracker

This tracker provides key metrics to help monitor your association's financial health. It includes areas like membership retention rates, operational costs, and revenue growth, allowing you to track performance and make data-driven decisions.

Risk Mitigation Action Plan Template

The action plan template helps you develop strategies to address and reduce identified financial risks. It provides step-by-step guidance on how to prioritize risks, set goals, and implement measures to safeguard your association’s financial stability.

These tools are designed to simplify the process of managing financial risks and give you the clarity and confidence to make better financial decisions for your association. You can use them right away to take control of your finances and protect your organization’s future.

How Glue Up Safeguards Associations from Financial Risks

Glue Up’s comprehensive all-in-one financial management tools are designed to help associations mitigate and manage financial risks effectively.

Glue Up provides associations with the insights needed to identify and address financial risks before they become major issues. Let’s explore how it gives associations the confidence to stay financially secure and prepared for the future.

Automate Manual Tasks

You can automate tasks like invoicing, payment processing, and tracking to improve accuracy and reduce human error. Streamlining your financial workflows helps you avoid mistakes that could lead to financial instability or compliance issues.

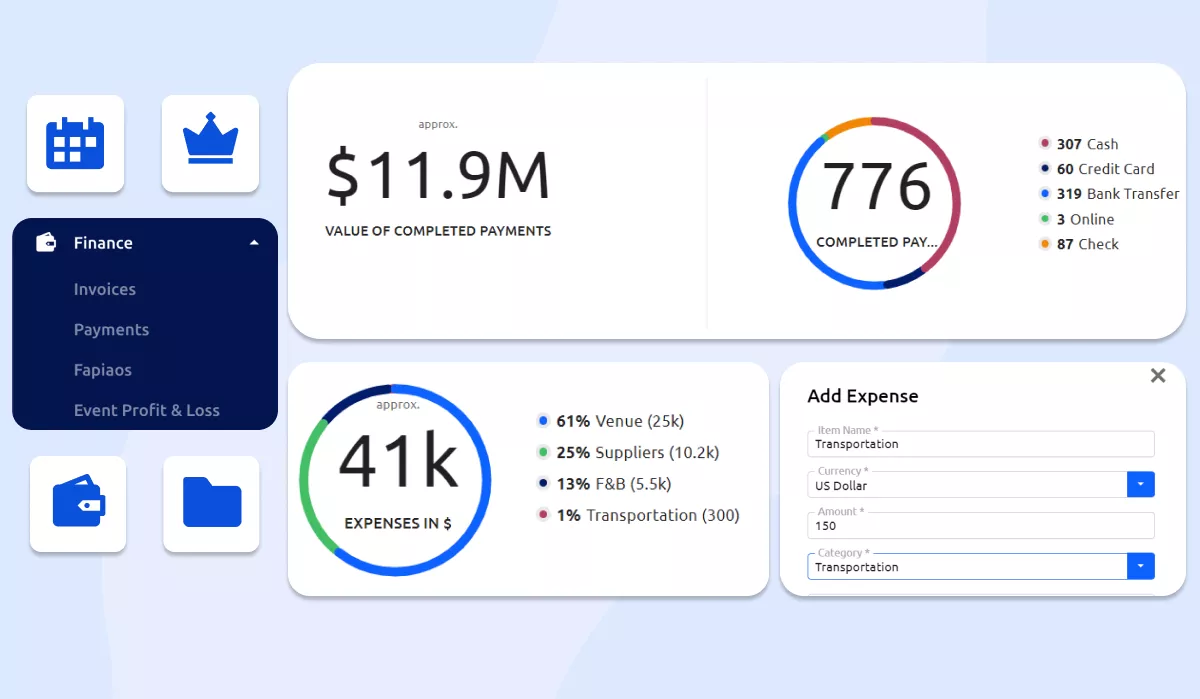

Stay on Top of Your Financials

With access to real-time financial reports, you can quickly identify potential risks, such as cash flow issues or unexpected expenses, and take proactive steps before they escalate.

Multi-Currency Support

If your association operates internationally, accepting payments in multiple currencies reduces financial risk. This feature makes it easier for you to accommodate global members and guarantees smooth, reliable revenue streams from various countries.

Local Payment Methods

You can offer your members preferred payment methods, such as credit cards, bank transfers, and online payments. This will help you maintain reliable payment collection and reduce the risk of missed payments or financial discrepancies.

Secure Payment Gateways (SSL Protected, GDPR Compliant, PCI DSS Certified)

Payment security prevents fraud, cyber threats, and legal liabilities. Secure payment gateways reduce the risk of data breaches and protect your association from potential financial and reputational damage.

Real-Time Analytics and Customizable Dashboards

Analytics allow you to monitor your association’s financial health and spot potential issues, such as underperforming events or declining membership renewals. This insight helps you manage risks before they develop into significant financial problems.

P&L Reports and Easy Export

Access to clear, up-to-date Profit and loss reports allows you to understand your association's financial status. This transparency helps you make better decisions and manage risks proactively so your association remains financially stable.

Automatic Invoicing and Custom Reminders

You can also automate invoicing and reminders to help you receive timely payments. This reduces the risk of overdue dues or cash flow interruptions, keeping your association’s finances stable and avoiding revenue shortfalls.

Customizable Tax Setup

Managing taxes accurately and efficiently reduces the risk of penalties and ensures compliance with regulations. This protects your association from legal issues that could otherwise threaten your financial health.

Advanced Integrations (QuickBooks, Xero)

Integrating your financial tools with accounting software such as QuickBooks or Xero streamlines your accounting processes. This reduces the risk of errors and ensures you have proper documentation for audits.

These features help you streamline financial operations, mitigate risks like payment delays, fraud, or compliance issues, and provide the tools you need to maintain long-term financial stability and sustainability in an increasingly complex environment.

Book a demo today to see how Glue Up can help you manage financial risks effectively and set your association up for long-term success.